tax on venmo over 600

Venmo PayPal and other payment apps have to tell the IRS about your side hustle if you make more than 600 a year. If you make more than 600 through digital payment apps in 2022 it will be.

Venmo Paypal Cash App Must Report Payments Of 600 Or More To Irs Kiro 7 News Seattle

Under the IRS new.

. AP Buried deep in the COVID relief law that Democrats rammed through last March is a provision forcing Venmo PayPal and other third-party payment services to send the. This applies to those who have a business and are set up to accept payment cards or payments from a third-party settlement organization then you will receive a Form 1099-K but. Starting this month users selling goods and services through such popular sites as Venmo Etsy and Airbnb will begin receiving tax forms if they take a payment of more than.

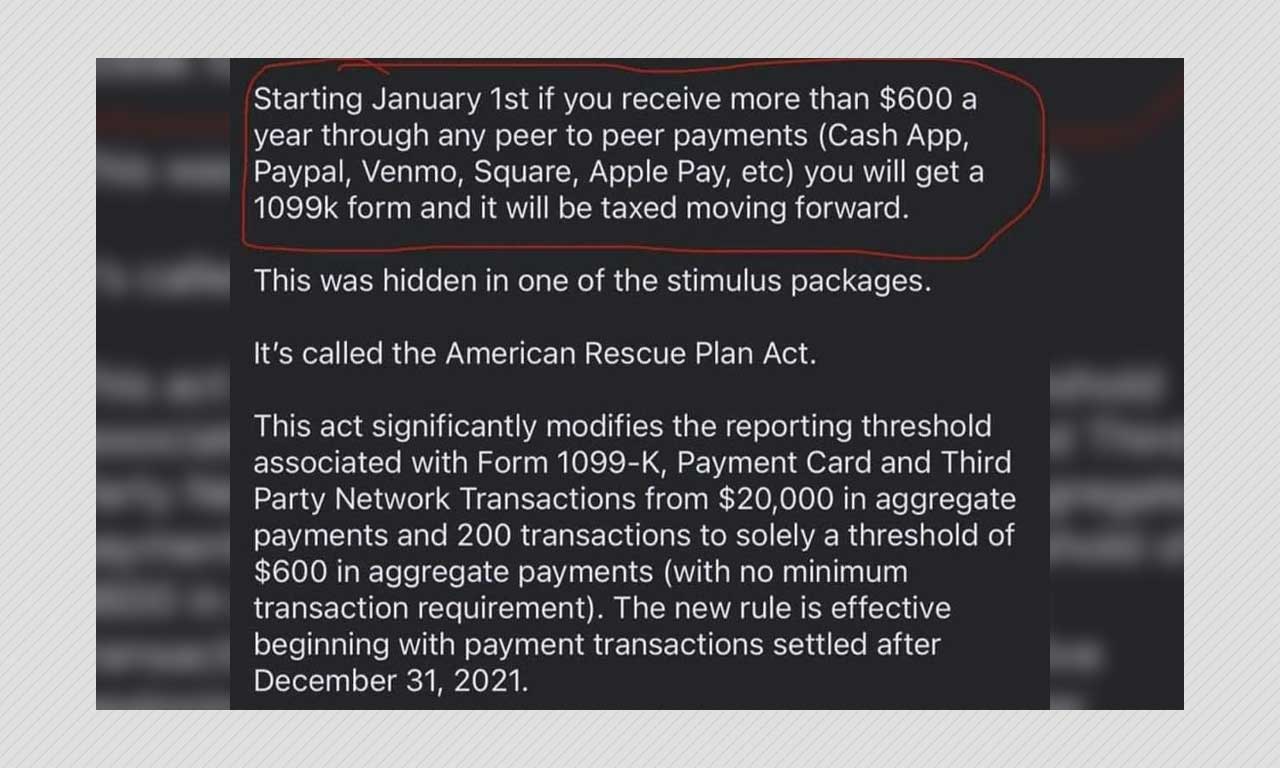

Anyone who receives at least 600 in payments for goods and services through Venmo or any other payment app can expect to receive a Form 1099-K. If the aggregate amount of payments to a participating payee exceeds 600 for the calendar year then the third-party settlement organization must file and furnish a Form. AT the start of the New Year business owners using third-party payment processors were forced to report 600 transactions or higher to the IRS.

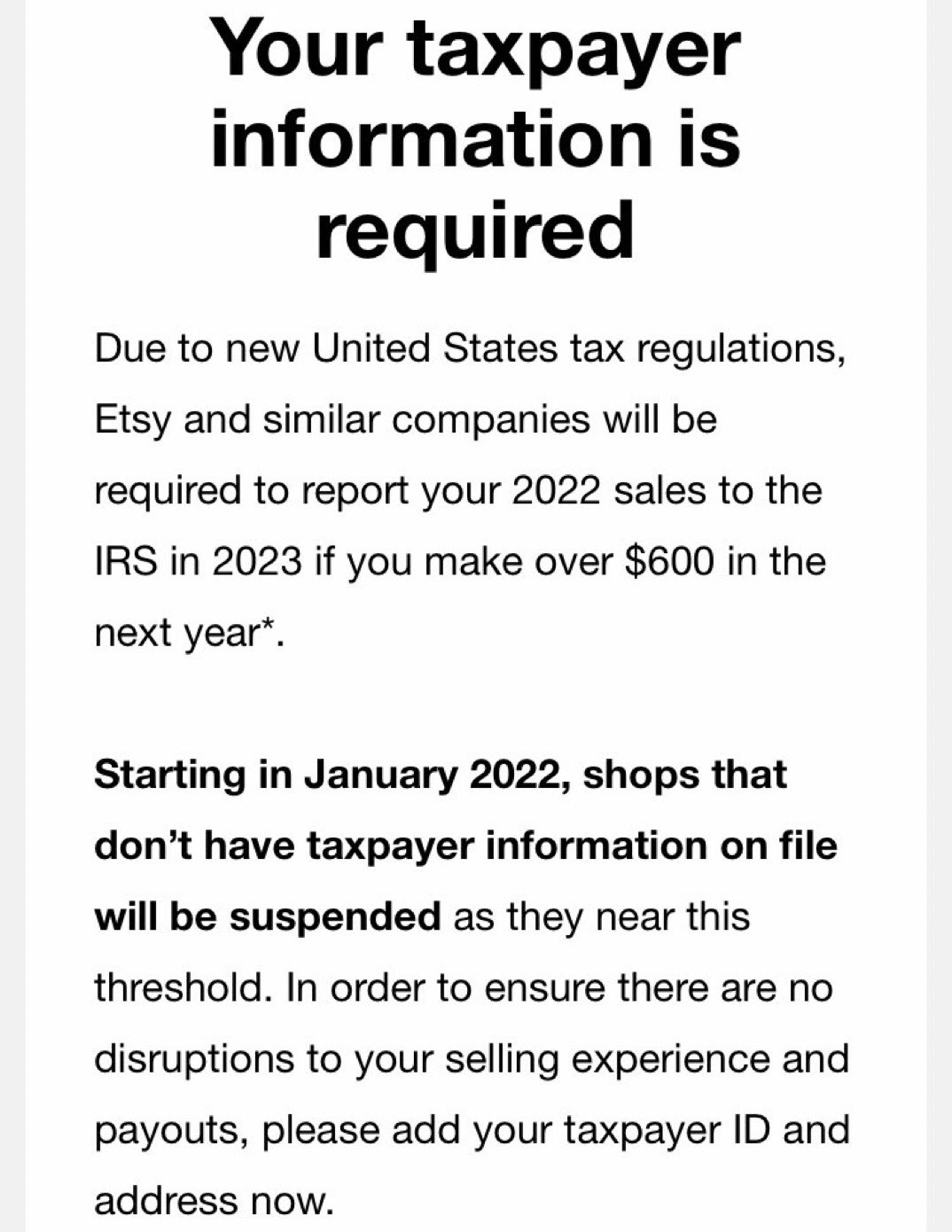

If you receive more than 600 through cash apps you will receive a 1099-K in 2023 for transactions that occurred during the 2022 tax year. Any income you make over 600 is now being reported to the Internal Revenue Service by payment apps including eBay Venmo and Airbnb. Since the beginning of the new year Venmo PayPal and other so-called peer-to-peer payment platforms are required to report income to the IRS if a user accumulates at least.

The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal. No Venmo isnt going to tax you if you receive more than 600 Tech Apps and Software A recent piece of TikTok finance advice has struck terror into the hearts of payment. If your Venmo or CashApp transactions exceed 600 and qualify as taxable income you will likely be sent a 1099-K by the IRS to fill out.

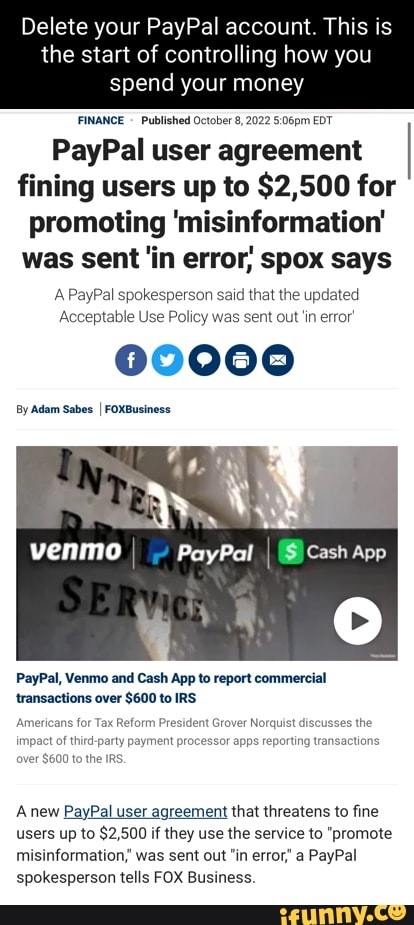

Side hustlers beware. According to PayPal while banks and payment service providers like PayPal and Venmo are required by the IRS to send customers a Form-1099K if they meet the 600. This new rule wont affect 2021 federal tax returns but now.

The new law which is in effect for. Per last years American Rescue Plan Act so-called peer-to-peer payment platforms like Venmo or Paypal will now have to report any persons cumulative business. Third-party payment processors like Venmo PayPal and Cash App are now required to report a users business transaction to the IRS if they exceed 600 for the year.

The IRS requires payment processing apps to issue 1099-K forms to businesses once they hit a certain threshold. This does not mean that you will. Fact or Fiction.

As previously mentioned a copy of this. It was modified from its prior 20000 in-aggregate payments and 200 transactions to a new threshold of 600 in-aggregate payments with no minimum transactions. Youll Owe Taxes on Money Earned Through PayPal Cash App and Venmo This Year.

While Venmo is required to send this. The new tax reporting requirement will impact your 2022 tax return filed in 2023 Payments of 600 or more for goods and services through a third-party payment network such. But users were largely mistaken to believe the change applied to them.

This year that threshold was lowered from 20000 to 600. New Cash App Tax Reporting for Payments 600 or more Under the prior law the IRS required payment card and third party networks to issue Form 1099-K to report certain. According to FOX Business.

New Irs Tax Proposal Draws Mixed Emotions From Business Owners Financial Experts Wach

New Tax Law Venmo Cash App To Report Business Transactions Over 600 Wrvo Public Media

New Venmo 600 Rule 1099k Reporting Explained Youtube

/arc-goldfish-cmg-thumbnails.s3.amazonaws.com/11-17-2021/t_898305d5e0f045668602ec21aac9347b_name_Payment_apps_to_report_wires_of_600_or_m_619547b329f511256af6fd6e_1_Nov_17_2021_19_16_22_poster.jpg)

Venmo Zelle Others Will Report Goods And Services Payments Of 600 Or More To Irs For 2022 Taxes Whio Tv 7 And Whio Radio

New Tax Law Sell More Than 600 A Year Venmo Paypal Stripe And Square Must Report Your Income To The Irs Gobankingrates

Advice On Venmo Having To Submit Sums Over 600 To The Irs R Personalfinance

New Venmo Paypal Tax Reporting Rules What You Need To Know Hourly Inc

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

The Irs Will Start Collecting Taxes On Venmo Transactions Sparking A Surge Of Memes Know Your Meme

American Rescue Plan Act Does Not Tax Payments Made Through Venmo Paypal Boom

Reporting 600 Cash App Transaction To The Irs New Tax Law Explained Answering Questions Youtube

Report Biden S Irs Plan Would Allow Surveillance Of Small Bank Accounts Venmo Paypal And Crypto

Venmo Paypal And Cash App To Report Payments Of 600 Or More To Irs This Year What To Know Fox Business

New Irs Rule Requires Paypal Cashapp To Report Payments Over 600

Delete Your Paypal Account This Is The Start Of Controlling How You Spend Your Money Finance

New Irs Tax Proposal Draws Mixed Emotions From Business Owners Financial Experts Wach

Apps Now Required To Report Business Payments Exceeding 600 Annually

Beez On Twitter People Really Fell For Tax The Rich Campaign This New 600 Tax Law Isn T For The Rich Etsy Sellers Are Now Required To Pay Taxes If They Earn Over

Ebay Or Etsy Sale Of 600 Now Prompt An Irs Form 1099 K Money