how to calculate pre tax benefits

Calculate how much more money you could take home when you use a pre-tax benefit. The next step before arriving at net income is to multiply.

4 Ways To Maximize Savings With Pre Tax Deductions

Identify potential pretax deductions.

. Pre-Tax Margin 25000000 100000000 25. When an employee pays for benefits such as health insurance with before-tax payments the deduction is taken off their. Annual Gross Salary Total annual salary before any deductions.

After deducting the health insurance premiums. Pre-tax profits are calculated as follows. Pay Period How frequently you are paid by your employer.

Employer-sponsored plans are typically pre-tax deductions for employees. For 2022 the standard. Some facts about Saras pretax deductions.

How to calculate pre-tax. Actual Cost Of Pre-Tax Contributions. 403 b plans are only available for employees of certain non-profit tax-exempt organizations.

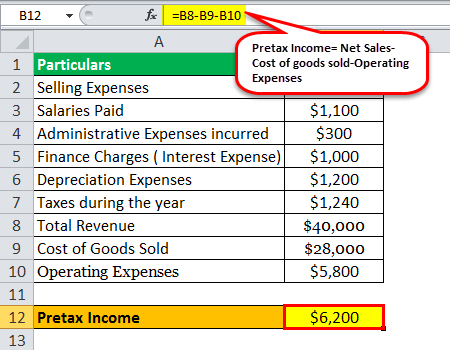

Pre-tax Income Gross Revenue Operating Depreciation and Interest Expenses Interest Income. Personal use is any use of the vehicle other than use in your trade or business. By offering employees a pre-tax commuter benefit program the cost of commuting deducted for employees reduces the amount of payroll being taxed.

Follow these steps the next time you do payroll. Profilename Drag Slider to. Say you have an employee with a pre-tax deduction.

Pre-tax deductions are payments toward benefits that are paid directly from an employees paycheck before withholding money for taxes. First indicate if you are insuring just yourself or your family. 501c 3 Corps including colleges universities schools hospitals.

How to calculate pre-tax health insurance. When you begin payroll withholdings you will first withhold the 401 k contribution because it is pre-tax. In the following boxes youll need to enter or select.

Actual results may vary. How to calculate pre-tax health insurance. Calculate how much more money you could take home when you use a pre-tax benefit.

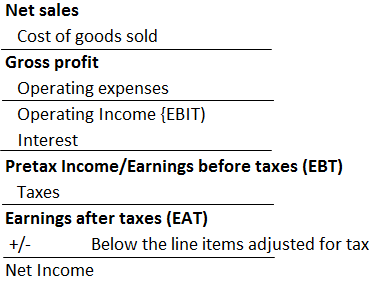

Divide the EBT by the revenue to get the pre-tax profit margin. This means a savings of up to 765 on. Say you have an employee with a pre-tax deduction.

The results provided are an estimate based on the information provided in the input fields. Profilename Drag Slider to Estimated. This is the formula for calculating pre-tax income.

In most cases deduct the employee-paid portion of the. From there enter your annual contribution annual catch-up contribution and both the federal and state tax percentages. 2000 X 765 153.

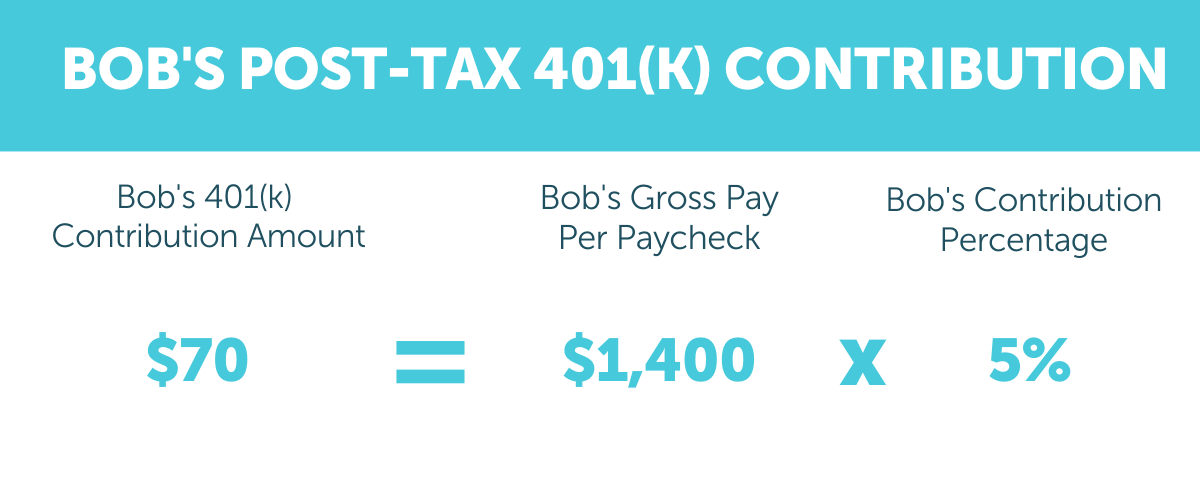

Step 1 Calculate gross compensation for the pay period. This amount must be included in the employees wages or reimbursed by the employee. Peter contributes 5 005 per pay period to a pre-tax 401 k plan.

Identify applicable payroll taxes. Pre-Tax Income Revenue Expenses excluding Taxes How to Calculate Pretax Income. There are two types of benefits.

Formula for Pre-tax Income. But a Section 125 plan is pre-tax. 403 b Savings Calculator.

The deduction is 50 per payroll and you pay the employee a gross pay of 1000 per biweekly pay period. 2000 300 1700.

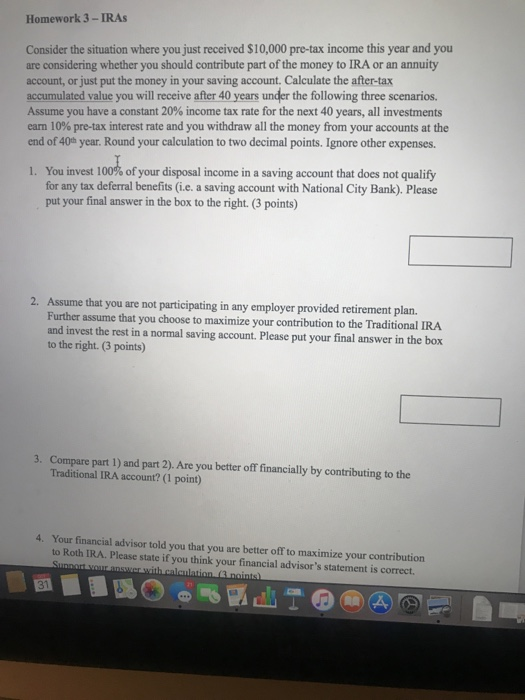

Homework 3 Iras Consider The Situation Where You Just Chegg Com

After Tax 401 K Contributions Retirement Benefits Fidelity

Pre Tax Vs Post Tax Deductions What Employers Should Know

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Understanding Pre Vs Post Tax Benefits

Calculating Household Income Ppt Video Online Download

Are Payroll Deductions For Health Insurance Pre Tax Details More

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

Cost Of Debt Kd Formula And Calculator

:max_bytes(150000):strip_icc()/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)

Payroll Taxes And Employer Responsibilities

Pretax Income Formula Guide To Calculate Earnings Before Tax Ebt

What Are Payroll Deductions Pre Tax Post Tax Deductions Adp

Calculating Pre Tax Cost Of Equity In Excel Fm

Pretax Income Formula Guide To Calculate Earnings Before Tax Ebt

Net Operating Losses Deferred Tax Assets Tutorial

Pretax Vs Post Tax Tax Videos Video Chef Youtube

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

:max_bytes(150000):strip_icc()/dotdash_Final_Net_of_Tax_Dec_2020-98efd407350341fdb178949dadd84c5c.jpg)

Net Of Tax Definition Benefits Of Analysis And How To Calculate